|

| OFFICIAL DEBT TICKER:

October 1, 2010

|

|

| $18,918 (un-secured)

$16,745 (co-signed)

$33,079 total

$32,579 total

$30,736 total

$27,920 total

$29,058 total

$28,637 total

$29,106 total

$28,598 total

(as of 1-25-12)

$22,151 total

(as of 6-1-14)

Original Debt 12/06 = approx. $44,000

(current forgiven amount via settlements = $17,384)

| |

|

| PERSONAL LOANS |

|

|

|

| PERSONAL ACCT. |

|

|

|

| STUDENT LOANS |

|

|

($6,000 1/31/08)

($2,000 3/6/08)

$8,000

(payment plan pending)

($1,500 + $20.00 x 2 - AUG '08)

$3,040

(payment plan pending)

July, 2014

($11,040 + $4,615 for Sallie Mae payoff)

TOTAL DUE 9-1-14

$15,655

| $9,273.66

$9,088.66

$8,907.66

$8,569.78

$7,878.64

($9,000 + $270 bal xfer fee @ 3%)

borrowed 11-21-07 / posted 11-27-07

$185 minimum = PAID 1/4/08

$181 minimum = PAID 2/4/08

$178 minimum = PAID 3/6/08

$175 minimum = PAID 4/4/08

minimum = PAID 5/08

minimum = PAID 6/08

minimum = PAID 7/08

minimum = PAID 8/08

minimum = PAID 9/08 (late)

minimum = PAID 10/08 (late)

minimum = PAID 11/08 (late)

$156 minimum = PAID 12/16/08 (late)

minimum due = 1/8/0

TOTAL DUE 1-25-12

$5,705.49

minimum due = Jan 2012 $427.00

TOTAL DUE 6-1-14

$4,196.97

TOTAL DUE 9-1-14

?

| IN FORBEARANCE (1/07 - 1/08)

$10,187.49

($9,414.29 + 773.20 quarterly interest accrual)

Mar = 132.02

Jun = 179.31

Sep = 186.10

Dec = 189.86

IN FORBEARANCE (1/16/08 - 1/15/09)

(resume pay at $384/mo min resuming 2/15/09)

$10,187.49

APPLYING FOR 3rd FORBEARANCE 12/08

(DENIED)

NEW FORBEARANCE 2010

LAST FORBEARANCE 2011

TOTAL DUE 1-25-12

$11,852.87

MIN DUE 2-15-12 = $610.00

July, 2014

PAID IN FULL AND CLOSED

|

|

| BIZ TAXES 2007 |

|

|

|

| BIZ TAXES 2006 |

|

|

|

| PERSONAL ACCT. |

|

|

(minimum required plus late fees & interest)

DUE 5/1/07

(estimate unknown)

DUE 5/1/08

BUSINESS DISSOLVED

| (unknown + late fees)

PAST DUE

BUSINESS DISSOLVED

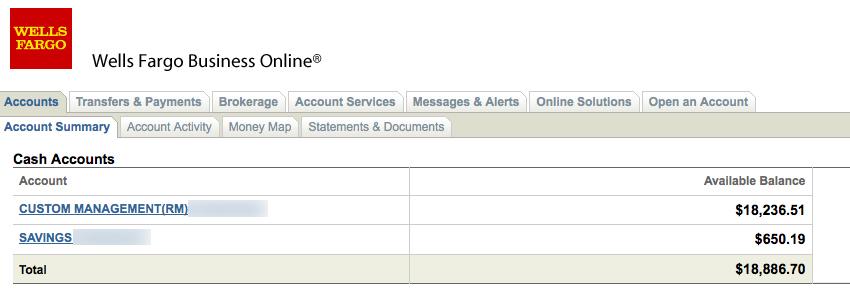

| (account suspended 11/15/07)

$2,336

PAID IN FULL 11/30/07

(account will cue in May '08 for review and

possible reinstatement pending credit standing)

ACCOUNT REINSTATED 10/08

BORROWING AMOUNT RESTRICTED

DUE TO "LACK OF USE" 6/10

|

|

| TAXES 2007 |

|

|

|

| TAXES 2006 |

|

|

high estimates:

$3,183 w/

forgiven debt reported 1099-R

$643 based on earnings only

DUE 4/15/08

PAID IN

FULL AND CLOSED

| $1,880

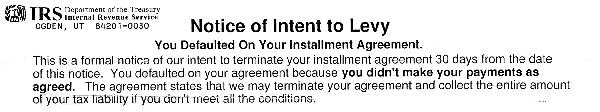

(payment plan = $35/month)

10/15/07 =

$35 PAST DUE

11/15/07 = $35 PAST DUE

12/15/07 = $35 PAST DUE

1/15/08

= $35 PAST DUE

2/15/08 = $35 PAST DUE

3/15/08 = $35 DUE (PAID

$210)

(narrowly dodged losing monthly payment

agreement and levy

of bank account

due to being 5 months late.

my check posted only a

few days

before I received 30 day warning notice)

| 4/15/08 = $80 DUE

($35

DUE + $45 reinstatment fee)

5/15/08

= $35 minimum PAID

6/15/08 = $35 minimum PAID

7/15/08 = $35

minimum PAID

8/15/08 = $35 minimum PAID

9/15/08 = $35 minimum PAID

10/15/08

= $35 minimum PAID

11/15/08 = $35 minimum PAID

12/15/08 = $35

minimum PAID

1/15/09 = $35.00 DUE

2010

PAID IN

FULL AND CLOSED

|

|

| BUSINESS CREDIT LINE |

|

|

|

| PERSONAL ACCT. |

|

|

|

| BUSINESS ACCT. |

|

|

$8,856

$5,904

$5,404

(no settlement option)

3-pay

installments agreed

11-30-07 to keep from legal

$2,952 (1 of 3) =

PAID 11-30-07

$2,952 (2 of 3)

$500 (2 of

3) = PAID 12-20-07

$5,404 (3 of 3) = DUE

1-28-07

(deadline extended to 2-1-08)

$5,404 (3 of 3) = PAID 2-1-08

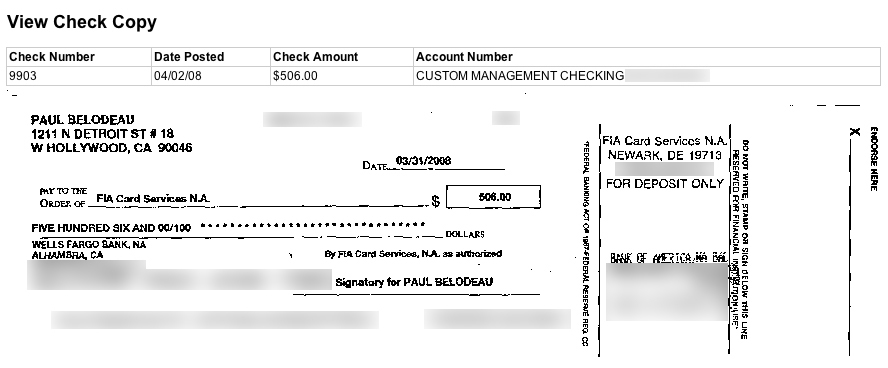

| $15,000

$3,200

$2,460

(settlement = $410/month)

$302 deal deposit (10%) = PAID

$410 (1 of 6) = Oct '07 PAID

$410 (2 of 6) = Nov '07 PAID

$410 (3 of 6) = PAID 1/2/08

$410 (4 of 6) = PAID 1/26/08

$410 (5 of 6) = PAID 2/29/08

$506 (6 of 6) = PAID 3/31/08

PAID IN FULL AND CLOSED

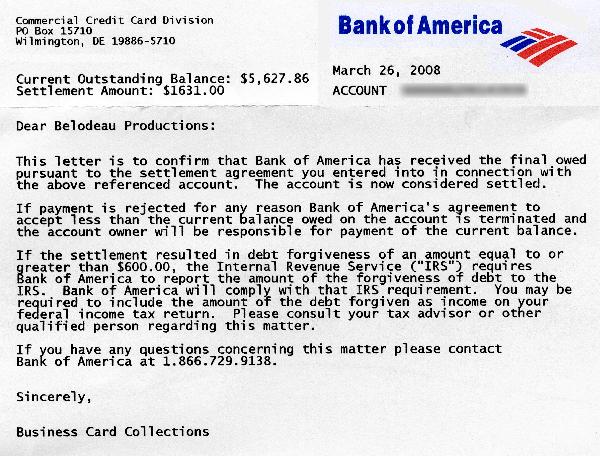

| $6,303

$3,001

$1,631

$730

$365

(settlement = $901 + $700/month x 3)

$901 (1 of 1) = DUE NOV 30, 2007

$901 deal deposit = PAID 12-31-07

$365 (1 of 2) = PAID 1/30/08

$365 (2 of 2) = PAID 2/29/08

PAID IN FULL AND CLOSED

|

|

| They cancelled me for being a few weeks late after 20 years of spotless history. They said I wouldn't be allowed to re-apply for at least a full year and only after a special review. Then, 6 months later, these started rolling in and have ever since...

|

|

9-3-14 - Been off this site for a few years...

|

|

| 3-12-13 |

|

|

1-25-12 - Been off this site for 15 months...

|

10/1/10 - Been off this site a year. Looking to have another 'numbers gathering' at my place this week to do receipts. I finally reached ONE FULL YEAR OF ABSTINENCE the 2nd week of this past month. Work is good. I have slipped into a mode where I don not spend a lot. I do not want to "live small" but I find that the more money I earn, the more I appreciate it and don't want to spend it(!) I feel good about this. I managed to go home for another extended visit to family over the summer- bookended between two jobs- and for the first time ever, NOT worry at all about expenses. I also did not have to borrow money from family as an advance on forthcoming work checks. I received all my checks before leaving on my trip- another first.

I am currently in a direct payment schedule with CHASE on my credit card debt with them. I had stopped paying and they were ready to go to legal in less than 60 days(!) When I called to work it out, they offered a flat settlement- couldn't believe it. Perhaps things have changed since the economic meltdown of 2008-09. I qualified for another forbearance with SALLIE MAE and my payments are deferred a while. I am unclear on the amounts and dates- but have 3-ring binders documenting everything, so, as long as i keep up with hem, i am in good shape.

My DA program step-work stalled over a year ago on step-8. The death of my father and other issues, especially a lot of travel, have caused delays. We noted the one-year anniversary of my Dad's passing this past week. I am happy to find my Mom and myself both i good spirits and looking toward the future. I helped my mom do her "numbers" over the summer and shop for a new car. This was a scary venture for her, but she purchased a wonderful new vehicle she is quite happy with.

|

12/23/08 - As 2009 approaches, i'm prepping myself for clarity around all my finances and debts, as well as my new business plans:

- apply for third forbearance with Sallie Mae

- establish payment plan for debt i owe my mom

- deal with 2006 and 2007 WeHo business taxes

- re-instate my sole proprietorship in WeHo

- calculate my debt forgiveness taxes and regular taxes and be prepared for IRS payment plan

- implement my "A-Vision" business plan as music video director

- build and launch new website, biz cards and promo materials

- attend Mark Z's thursday night networking meeting in Burbank

- implement new "B-job" business plan to grow graphics career. Market and promote.

- keep up with my numbers spreadsheets

- have further PRG's as well as business PRG's

- research and implement plans for living in NY during summers from now on

Good timing for me that the New Year happens as i begin step #6 in my program:

STEP #6: "Were ready to have God remove all these defects of character."

Tomorrow is Christmas day and only today did I stop to realize I have done nothing to prepare gits or even holiday cards for firnds and family. This is un-acceptable and i'm feeling like a louse. Part of my recovery needs to be measuring the difference between self-focus and self-absorbtion. Yes, i'm working and showing up and stepping into the furue- but i can do this while still showing up for others too. My mom in particular, loaned me $11,040 this past year to help me deal with my debt problems. I have failed to follow through with a payment plan to make good on my promises with her. I could've at least sent an X-mas card...(yeesh) Somehow, despite thinking about these things all the time, I never hold on to the thoughts with clarity- at least not enough to commit to action. I suppose part of my Step #6 meditation will be to realize I need to continue "getting out of my own head" with things and turn them over to other people in effort to make myself clear and accountable.

As 2008 comes to a close, I am so very grateful for all the blessings in my life and recovery. Some of the items on my first "Visions Board" have come into my life. I have, for the first time ever, a comprehensive business plan for my filmmaking career here in Hollywood. I have also realized how to apply more business priciples to expanding my graphics "day-job" career. I need to quadruple my day-job income very soon. My experience of establishing clarity over vaguness has made room for greater focus. I've found that focusing down on one or two things with a commited effort far outweighs the busy running around in my head that has for so long brought sparce results. I continue to battle to stay "present" on a daily basis. I continue to turn over my resentments, step into faith and focus on being grateful for what is, rather than obsess on what isn't. I continue to re-discover the depth and meaning of the Serenity Prayer- that I need to stay ever aware of what I can change and what I can't and see the difference between both.

|

12/15/08 - Been offline here a while. No accident that my last log-in was April when my default ended. Since then my D.A. program has had a different feel and color.

3-1/2 months abstinent

|

|

| VISION INTO REALITY... |

|

|

11/08 - Mounted a massive de-cluttering of my apartment which went on for some six weeks. If i'm going to live in this space, i can at least follow through on long held intentions of fixing it up how i want/need it. At first i was just going to donate lots of stuff to Salvation Army and Good Will. I even contacted the L.A. Homeless Shelter. As i sorted through the stuff and tore apart my densely packed closets- i realized i should probably try to sell some of my electronic music equipment at least. I delved into Craig's List online for the first time. I took professional looking photographs of all my items and built a quick web page for them. Within 1/2 hour of posting online, i received 6 responses through email and by phone! the next day i sold nearly everything. I expanded the site, raised my prices and started wondering what else i could sell instead of throw away. I ended up with an ongoing site called "Paul's Garage" and will continue to post items as time goes on. I made approx. $375.00 on items i never expected anyone would want. I purchased a used SONY "34 TV from Craig's List that i have wanted forever. I invested around $50.00 in lumber and built the entertainment stand i've always wanted. It frees up space and clutter and organizes my gear nicely. Not a big deal in the scheme of things, but made me feel a tremendous sense of accomplishment.

It dawned on me, to try looking up used Apple iMac's on Craig's List. Sure enough, i found exactly what i wanted within a week and purchased a used iMac G5 17" fully loaded with all the software i need to run my video, graphics and music projects. Wow, i could hardle believe it. iMac = $375, extra RAM = $40.00, OS disk = $140.00 (total investment = $555.00) I later realized this exact iMac unit was on my first Vision's Board and i had a ful page ad image of it on my wall. Now i'm editing all my video projects for my professional reel and my "A-Vision" business plan is officially launched. I'm overwhelmed.

|

10/08 - Attended my second Vision's Retreat with D.A. up at Casa de Maria in Santa Barabara. What an amazing experience. I found myself creating my third Vision's Board- this one focused very specifically on my "A-Vision" filmmaking career plans for 2009. Additionally, i made a flow chart on all the steps involved in the business plan and presented it to the grooup. I met many other creative professionals and filmmakers who really "got me" and have since supported my efforts and given much encouragement. I lost the flow chart on the ride home, so i made a fullsize one and mounted it on the wall. I also made a wish list of dream clients to put on the wall. I purchased several magnetic dry-erase boards for my wall to write my weekly numbers on, as well as post business and vision items for clarity. LOUD AND PROUD!

|

STEP #5: "Admitted to God, to ourselves, and to another human being the exact nature of our wrongs."

STEP #4: "Made a searching and fearless moral inventory of ourselves."

|

9/08 - Awaiting a big check from recent job, reality became clear it would not come in time for me to pay my monthly for Sept and Oct. Despite doing all the numbers and having a sublet cover my summer rent, i'm broke and the check won't save me. After emailing my sponsor about it, i made the painful decision to break 10 months of abstinence and borrow money from my mom until the check comes. She wired my account twice, each time for $1,500 plus the $20 wire fee. I owe her $3,040 total. The plan was to pay the first half when the check came. When it came, it was so late, i asked if i could wait until my next work check first- so as not to go broke again. Mom agreed and then of course, by the time the second check, there was simply not enough to pay her a lump sum at all. Perhaps debting was not the answer(!)

Zero days abstinent again...

|

|

| AND THERE'S MORE...! |

|

|

|

| PREDATORY CHARGES |

|

|

|

| IT'S EXPENSIVE TO BE POOR... |

|

|

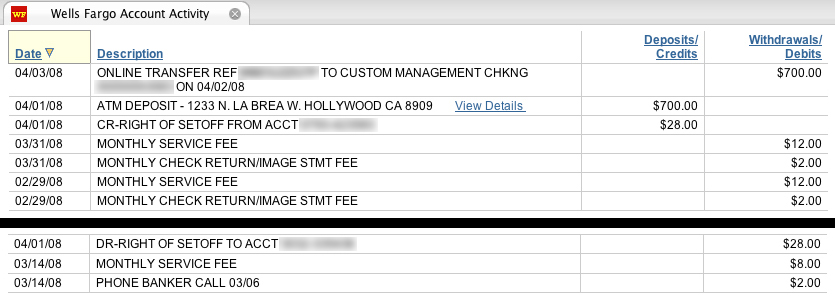

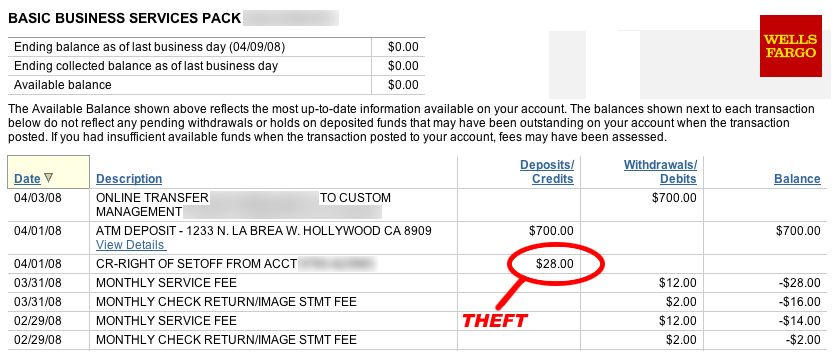

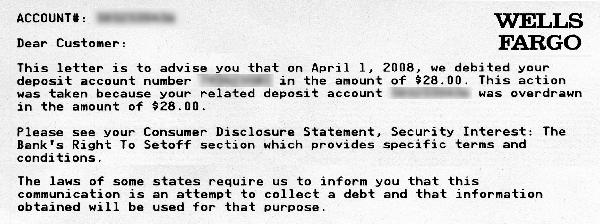

4/7/08 - On the last day of last month (March) I deposited a $700 check into my business checking acct. which has been carrying a zero balance for 30 days. Because Wells Fargo has lame fees for monthly checking and a lot of penalties i can never remember- for when your balance is under a certain amount (which it always is in my case) the fees put me into a negative balance. After a certain amount of time (i also don't remember) with a neg bal, the bank has a "set-off" right which means they can debit your other accounts for the amount i guess. Although, they made it clear to me recently that my business and personal accounts are not at all linked, it seems this "Set-off" thing over-rides that. When i went online to do my banking, i noticed the $28.00 set-off charge was pending, so i yanked all my funds out of my biz acct in hopes of denying them the opportunity to debit me. I'm not sure what happened exactly, since my xfer was pending and second in line to their "pending" debit. Nonetheless, i got this letter in writing informing me that they stole the $28.00 from my personal account to cover it. I had intended to call them and explain that i was "holding my money for ransom" and not allowing them to take my $28.00, but apparently they can do whatever they want. I had intended to demand that they reverse the charges but I'm sure it's too late. What a total drag. Ironically, i have a big check coming that will cover everything for a while, but right now, I'm broke- back at zero- so all the stupid fees are dinging me and I'm sort of powerless to defend myself. i actually really need that $28.00 to cover my IRS minimum next week, which i currently am short on. Wow, it never stops does it!? To think, i deposited $700 dollars and TOOK CARE OF THINGS, but within the same matter of hours they charged me for a zero balance. Once again, i came up short on the clock. Argh...

|

|

| PROGRESS... |

|

|

|

| MY LAST SCHEDULED E-PAYMENT |

|

|

|

| HIGHWAY ROBBERY... |

|

|

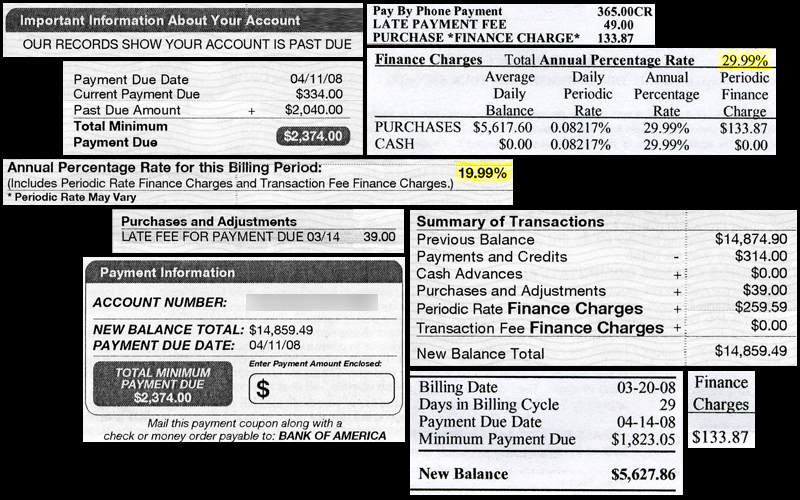

4/7/08 - My final scheduled payment to BOA went through and posted on 4/2, thus closing that agreement. So i am officially out of "default" now which is a nice accomplishment. Both BOA and Wells Fargo Biz Line are history. I managed to make my minimum payment to CHASE and protect my 0% APR Bal xfer deal. It feels strange after all these months of default with everyone to be rushing around to make minimum payments again. The difference of course, is i've now been through an odyssey that had changed my view and my feelings about all of it. It now feels like enacting my own plan and taking care of myself rather than some resentful kissing-ass-to-the-man or whatever. The due dates on my CHASE payments are a little squirrelly however. I had specifically logged 4/8 as this months due date, but the paperwork that came in listed 4/4- taking me a bit by surprise again. Luckily i was on top of things. I need to establish clarity on how to gauge this better. i've had several nice phone calls with my parents regarding my D.A. program and it's impact on life in general. This is a real blessing, seeing as how i was nervous to tell them all this time. i recently saw two documentaries about debt that really reinforced my views about the epidemic of debt and predatory lending in the U.S. these days: MAXED OUT and IN DEBT WE TRUST.

I'm currently on Step #3 with my sponsor...

STEP#3: "Gave ourselves and our will over to the care of God as we understand Him."

|

|

| What does the taste of HUMBLE PIE look like? |

|

|

3/14/08 - DODGED A BULLET- last week on 3/6 I finally mailed my catch-up payments to the IRS after missing (5) monthly payments. I brought the account current for 3/15. Early this week I got a notice to come to the post office to sign for a certified mail delivery. At first, I feared it would be the 1099-R's for my 2007 debt forgiveness (which I have yet to receive.) Today was the first I could get over and pick it up. It turned out to be a "Notice of Intent to Levy" from the IRS. (see above) I had been in a great, well rested mood, but of course, i froze- paralyzed. Once home, I re-read the letter and it indicated I had 30 days to bring the account current before the monthly payment agreement was cancelled and they would seek to Levy my bank account, possibly contact 3rd parties for information on me and consider Liens on any equitable property I may own (yikes.) I called the phone number and the gal on the other end helped a lot. I told them the date my check posted and that I was seeking to go back to the normal agreement. There was a $45 reinstatement fee, but the account indeed had become current as of 3/10 and she cancelled out the Levy warning. She made all the notes to my account, reconfirm my personal info and then asked me why I owed for 2007? At first I didn't understand, then she explained it was because as a business I should be filing quarterly estimated taxes. It was a bit like getting reprimanded by a grade-school teacher for handing in homework late. She also asked why I was late on my payment and if they were too much. I used honesty and explained my 15 months of dealing with creditors and debt repayment activity. I also explained that my last BOA payment goes through the end of this month, which is why I had applied for the IRS internet pay service (still awaiting PIN# in mail) and that I was looking forward to getting back to normal payments. She understood and I felt I had said the right things. I told her I looked forward to a solvent business in 2008 and looking into quarterly payments and some day even, "the holy grail of even having an accountant!" to which she laughed. The entire experience was very harsh and cold. I thanked her for the opportunity to re-instate and apologized for the missed payments. Yikes. She also explained that if I owe a balance on my 2007 taxes, it will trigger me into default again. Any form of owing them anything will trigger default and each time there will be another $45 reinstatement fee to fix it. If I owe and cannot pay for '07 or need to enter into another payment schedule, I am to call them immediately so that nothing triggers default. Any new payment schedule would be added into the existing one.

STEP#2: "Came to realize that a power greater than ourselves could restore us to sanity."

3/6/08 - Today my minimum Chase payment was due in order to stay on time and not lose my 0% APR balance xfer deal. I called my mom yesterday and 'fessed up as to my current crisis and asked for help. Today she wired $2,000 into my bank account. I feel defeated. I was able to get up without sleeping in all day however, and i got all the bills paid and all my finances organized. Incredible the energy you get with relief and heading off the depression/anxiety. I'm very thankful to my mom for being so understanding and supportive. She knows about my DA and ACA programs and that I'm actively in recovery and looking for support, not a "bail-out." Still, this is debting and breaking of program principles. We do it imperfectly...

0 DAYS ABSTINENT

I had figured my bank balance at $5.64 as of today, but the bank confirmed it would have been -$8.95 (overdrawn) when my pending purchases from yesterday cleared. However, the money from my mom saved me from ending up overdrawn. Once again, despite my obsessive efforts to track my spending to the penny, i was off and went into the negative. Again, the lesson here is that after you go under $100 in the bank, you can expect the unexpected.

I re-activated my lapsed AA membership $67 (since my vehicle is experiencing problems.) I also paid my IRS payments $210 which were now 5 months behind + this months due. My car insurance $149, paid all my utilities for last month and this month $225.72 and ordered my parking passes from the city $30 and paid a recent traffic ticket $47. Total spent today = $906.72. My annual for this website is due 4/12 as well.

I registered online for the iNet/pay-by-phone service with the IRS finally. This will help me stay on top of the monthly minimums in a big way. (Only took me a year to do it!) I found paperwork indicating that they already had sent my PIN# for this, but i do not remember signing up before. Anyway, will take up to 15 days to be processed and sent to me by snail-mail. I looked into the estimates on my vehicle repair i got at the dealer back in July and made a post-it note with the figures for clarity. I also made a post it for my estimated Federal taxes next month and updated all on this site. Next I have to purchase some dress clothes for catering work I have this coming week. Also, I will get a haircut and fill my gas tank. For next month, I need to have $506 for my final BOA payment, $635 for rent, $35 for my IRS '06 and whatever is due for IRS '07. I'm still behind on my city business taxes for '06+fees+interest and '07 is due 5/1.

3/4/08 - Broke again :-( I didn't earn enough in February to be prepared for March 1st. My (2) BOA scheduled payments plus my rent took all i had, leaving me with $57.33 in the bank and $2.00 in my wallet. I called BOA personal account to ask for a compromise and they allowed me a $96 discount (added to next months minimum) for a $314 payment instead of $410. My business account refused, saying "you will lose your entire

settlement deal if you don't make this payment in full." SO i let the payment go through at the full $365, which now closes that account(!) My rent was cheaper than normal because i deducted for a new lock i paid for. Argh... So i have scarcely money for food or anything else and all the bills are late. I went against D.A. principles to pay creditors first. I did this in order to not lose my settlement arrangements. i dunno if i could've played it out more or not. I missed my Chase minimum payment on the 3rd, which means i will lose my 0% APR balance xfer deal, thus creating ongoing new debt. I am also very behind in my IRS minimum payments and my new taxes for 2007 are all due. My city business taxes for 2006 are now over 1 year past due, so i have accrued late fees and interest. In short, i am debting all over the place. As i write this, i am physically hungry and thirsty because i have held of using the last few dollars i have until my payments cleared. I have freelance work coming, but not in time to take care of present due items. I need to buy a set of new clothes and shoes for the catering gigs I am doing next week as well as get a haircut. I will have to borrow money for these...

3/1/08 - Attended DA step study workshop today. Couldn't afford the registration of $25 but no one is turned away, so i promised to send it in later. We did steps 1-5 in a one day intensive. It was hard and emotional. I red-discovered some of my inner most therapy issues all over again, it left me keenly aware of where i stand in my recovery and, although quite sobering to behold, re-committed to moving forward.

|

|

| OPENED ENVELOPES... |

|

|

|

| I LET IT ALL BUILD UP AGAIN... |

|

|

WED 2/20/08 - finally opened mail, organized papers, made list of bills owed, checked bank account online, called creditors for clarity, called SALLIE MAE and got clarity on '07 forbearance interest accrual. Also, took a second 12 month forbearance. First good day.

THUR 2/14/08 - Met with my psychiatrist and we discussed my current anxiety predicament. He indicated that I have anger over the things I've been dealing with lately because they are beyond my control. This is a basic human reaction, very normal. However, the anger is projecting inside, not out. This becomes depression. The trick is for me not to be fooled by this illusion and keep doing as much as i can, even under duress. In the past, I would have waited until things changed on their own- like the weather or something. I've learned that i have to actively participate in turning the momentum around. One breath, one moment at a time.

MON 2/11/08 - Woke up at 8:30am (before alarm) in an anxiety attack. have the shakes and doubled over with fear. Cancelled everything and slept as much as possible all day- purposely. This has not happened to me in 4 years. I called therapist and pushed up appt. with my psychiatrist for this week.

SUN 2/10/08 - Met with my first D.A. sponsor for first time. Made action list for next 2 weeks and booked time to meet to follow up. I'm on step #1.

STEP#1: "We admitted we were powerless over debt- that our lives had become unmanageable."

|

FRI 2/1/08 - Returned from NY last night from family visit. my dad's surgery went great and things are ok. i told my mom about my DA program and my debt and everything. she was wonderfully supportive and said repeatedly how proud she was of me. it was all quite emotional. My mom loaned me $6,000 to cover the Wells Fargo Biz Line deadline ($5,404) and avoid legal- plus a little extra. I paid Wells today, so the account is now closed. This is after mom giving me $3,000 to cover bills and rent last month and paying my $440 plane ticket. Argh... I feel defeated and yet hopeful - i dunno. My defaulted debt is almost paid off, but the debt still exists because it has only been bounced. Fortunately, my mom is not charging interest or fees like everyone else. I committed drawing up a contract payment plan which includes giving a large sum of the corporate job i have coming up over the next two months. This is un-secured debting, but by staying out of legal with Wells i avoided the $5,404 doubling or tripling in court. I also paid my CHASE minimum $181 today and wrote my rent check $635. This coming week i will pay for a fix-it ticket, catch up my IRS payments (late) and order parking permits for my building. I do not have prudent funds to cover next months bills ad payments other than rent. I have to find work immediately. I left a message with my sponsor yesterday to get started on whatever next.

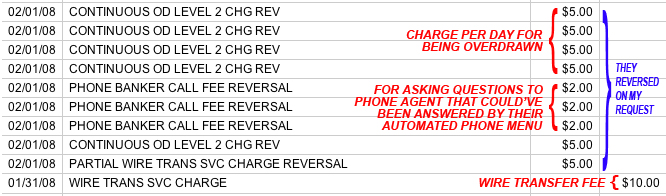

Clarity on bank account: it costs to be poor! my overdrawn situation at the beginning of January cost $5.00/day plus other penalties. $5/day X 5 days = 25.00 + $65.00 bounce charge = $90.00 total. That's a lot when you have a zero balance (!?) Also, i discovered on my account today some "phone operator charge" entries: $6.00 (3 X $2.00 each.) i called to inquire and they explained that "any question you discuss with a rep that could be answered by the automatic phone menu costs a $2.00 fee." I also had a $10 wire transfer fee which i wasn't aware about either. the operator nicely reversed both charges. i don't know when the reverse will show up on my account (not today.) this all seems so bogus.

Clarity on traffic ticket: my fix-it ticket for a broken headlight will be thrown out when i show an inspector that i fixed it. today i learned that it will cost a fee of $15.00 to have it looked at and then a court fee (?) to turn in the signed off ticket! what a racket! apparently it costs to NOT pay a ticket. gotta luv it...

|

|

| PREDATORY CHARGES |

|

|

Clarity on bank account: it costs to be poor! my

overdrawn situation at the beginning of January cost $5.00/day plus

other penalties. $5/day X 5 days = 25.00 + $65.00 bounce charge =

$90.00 total. That's a lot when you have a zero balance (!?) Also, i

discovered on my account today some "phone operator charge" entries: $6.00 (3 X $2.00 each.) i called to inquire and they explained that "any question you discuss with a rep that could be answered by the automatic phone menu costs a $2.00 fee."

I also had a $10 wire transfer fee which i wasn't aware about either.

the operator nicely reversed both charges. i don't know when the

reverse will show up on my account (not today.) this all seems so

bogus.

Clarity on traffic ticket: my fix-it ticket for a

broken headlight will be thrown out when i show an inspector that i

fixed it. today i learned that it will cost a fee of $15.00 to have it

looked at and then a court fee (?) to turn in the signed off ticket!

what a racket! apparently it costs to NOT pay a ticket. gotta luv it...

|

MON 1/14/08 - Well...this past Friday i decided i'd call my parents and see if they could help me with a loan for some amount to try and keep my settlement agreements going. I really didn't want to but wasn't sure if i needed to reach out for help or let it go. Then at lunch time, "Christine" from Wells Fargo Biz Line called to tell me that i had to pay the balance by the end of that day or be turned over to legal. I didn't have my paperwork with me because i was out, but remembered that it was supposed to be at the end of the month(!?) She said the deadline was actually Dec 31st but she had stretched it as far as possible. I told her my only recourse was to call my parents. She said if i thought i would do that, she would "lose" the paperwork on her desk till Monday if that helped- so i agreed. So i resolved to call my parents and at least cover all the options before being turned over to an expensive attorney and losing all he ground i've worked for. However...

When i got up Sat morning to go to my DA meetings, there was an urgent voice mail to call home. Turns out my Dad has to have surgery right away on an aneurism they just found on his main artery. It might get complicated. Also, my Grandma had been rushed to the hospital with her own heart ailments and probably won't be coming home, but going into an elder care facility where they can monitor her 24/7. So, big changes back home and anxiety of course. This hit me really hard in an already compromised week where i was bordering on depression for the first time in 4 years. i called home and my mom told me to book a flight on her credit card and she would wire me some cash to make it through the month. I didn't tell her about the debt or any of that, just that i "was broke" and she knows i won't be able to work much if I'm traveling. My mom is enduring enough right now- i couldn't possibly burden her more with my debtor crap on top of everything else...

i slept most of Saturday - purposely- just totally depressed. Sunday i booked a good flight online and then my mom decided to wire transfer $3,000 into my business account. This only depressed me more. I don't ask my parents for money- except three times in the past: 1) to finish my last year of college and graduate- which i couldn't do without a loan. 2) to purchase my (used) vehicle which i still have (10 yrs.) and 3) one time when i had no money for groceries a few years ago and needed some help. Although my parents don't have much, it hurts them not to help and when i don't ask them for help. i oscillate between not wanting to put my burdens on others- and allowing help when it is needed. Which is when??Sometimes it is bad for me to NOT allow them to help. i just want to be self-supporting through my own contributions. I dunno, it's all nerve-wracking...

So today (Monday) the $3k cleared my account today and I'm set to fly home Thursday morning. Of course, i had to make the call to Wells so i bookended, prayed, then dialed. Christine listened to my story and said she could extend the deadline one last time till Feb 1st but no longer. I didn't ask her to, but i think after all the painfully honest info i've volunteered up till now, she believed me and wanted to help. I feel the DA program has been a miracle in my life. I went for a run and worked out and then went to my Monday nite meeting and started to feel more relaxed for the first time in 5 days.

I really feel that the recovery I'm experiencing is the hopefulness i feel in place of the cynical resentment i used to obsess on. I'm actually daring myself to look at how a situation like all this can offer up opportunities. I need to continue to get out of my own way and do it on "God's time" not my own. I need to show up for my family and for the situation- whether convenient or not. I know i am an incredibly resilient person when I'm in the mix. i look forward to being what God needs me to be and letting the rest go. after all, it's the most relieving feeling there is.

THUR 1/10/08 - Accruing upwards of $5.00 a day in fines on my bank account overdraft. Paid my therapy monthly last night and my 2nd of 3-pay install on my vehicle insurance $149.00. put $5.00 cash in gas tank and spent $4.00 on fast-food for dinner. only have $220 left in bank and $30 in wallet. have $120 in outstanding invoices and then nothing after that... been over-sleeping everyday since new year's day. pills and alcohol at night to sleep and pills and caffeine in AM to wake. borderline depression but I'm able to steer away, unlike in years past. despite current ups and downs, I'm clearly noticing the recovery in my life compared to the past. used to be a certainty, now it's an option. i need to call my parents and ask for a loan, but i can't make myself do it. avoiding my mail and doing numbers again- don't wanna face any of it, not in the mood. haven't worked out in a week either. i know exactly what i need to do for myself to turn it around, but i just don't wanna. such is the cycle. in a day or so I'll post here in an entirely different mood and wish i hadn't written this. only constant is change. a friend at my men's group lost his dad and then a dear friend all in 2 weeks. I'm reminded of what i have and what's important over what i lack. i have a blessed life.

FRI 1/4/08 - i called CHASE and the phone menu said to pay online. i went online and couldn't remember my password so had to spend 20 minutes getting an email and re-registering for online access. turns out the 4pm payment deadline was Eastern Standard Time (not PST) so i missed it. i called on phone again and service guy said to go ahead and schedule online- it will post tomorrow 1/5 (late) but he will change it in my account so it posts 1/4. this was after i explained my online trouble delaying things. i then called Wells Fargo and got clarity on what will happen to my overdraft situation. The service person explained that it will remain overdrawn for 20 days, then go to collections dept. Each day it "may" incur a $5.00 fee (no clarity here.) i asked if the fee would show in the negative balance(?) as it is added and she didn't really respond. then the phone cut off. i updated my numbers and after the Chase payment and dinner last night at fellowship, i have a grand total of $57.44 in my biz checking and a negative balance of -$430.80 in my personal checking. After making the calls, doing the math and updating this page- i do feel a lot better thankfully. I guess i will call my family tomorrow and ask for an un-secured loan.

FRI 1/4/08 - Could barely get out of bed last 2 days. Trying not to get depressed. I have to pay $180 to CHASE for today's deadline or lose the 8 month 0% APR and i just can't do it. I have $300 to my name after my rent is taken out. I had to pay rent to my bldg manager last night with a business check for the first time, which made me really uncomfortable. My personal checking shows -$430.80 which would indicate that they went ahead and paid the $410 to BOA even though i only had $13 in the account. Now i have to call both BOA and my bank today to figure out what's up. I'm really behind on my IRS payments and my city taxes too. My main client dropped me yesterday which leaves 2008 in serious doubt already 4 days in. I got hired back on a corporate gig i do every spring yesterday which is good. i have to send them my latest deal memo with my rate increases. they will not be happy (i needed to send months ago, but failed to do so.) i really wish i could be someone else today. friends are starting to ask what I'm gonna do about the taxes on my forgiven debt this April. of course, i haven't a clue. i need to buy a decent outfit for a catering job i agreed to on the 17th but i have no money to do so. I worked at LSI Wednesday nite and made $100 under the table for 3 hours. i have approx $350 still coming in outstanding invoices- and then that's it folks. grand total of $750 to cover $7,000 due at end of January. (barf)

i made a call to a DA friend last nite to ask them to sponsor me. it's clear to me that i need to work the steps of the program in order to really bring my mind and emotions where they need to be in order to deal with my life better.

*note - when i phoned my bank to inform them that my BOA $410 would bounce, they "were not able" to tell me if the entire amount would bounce or if they would give BOA whatever was in my account (approx $300) This of course, was my main question. They said that when it cued, they would "do i quick investigation of the history of my account and decide whether to cover it all, partly or reject all-together." Now, if you can't get a clear answer from the bank, how can you establish any clarity at all? going over this with friends, everyone had a hard time believing me, "i've never heard of such a thing" was the general response. Well, that's it- DISCOVER "couldn't tell me" the policy on account reinstatement until AFTER i settled the balance. Now WELLS FARGO cannot tell me how they will handle a bounce even when you give them the info before hand. THIS WORLD IS FULL OF LIARS MASQUERADING AS PROFESSIONALS. In all sincerity, what more could i have possibly done on my end? yet- no clarity.

THUR 1/3/08 - Not

enough funds to cover- tried a "stop pay" with bank, but too late.

couldn't reach BOA due to holidays hours so amount will bounce and i

will be overdrawn. the bank cannot tell me if they will give BOA

whatever i have in the account when it hits, or if they will deny the

entire transaction. because of this, i have xferred my remaining funds

into my biz acct so nothing will post. my rent is covered in that acct.

plus $300. BOA told me to call FRI 1/4 and i couldwork out a reduced

payment and they will work with me because i have been good on my

previous payments.

TUE 1/1/08 - Starting off the new year by overdrawing my bank account $100 by bouncing a payment to a creditor. Yargh... As seen in a few entries below, i was supposed to finish my numbers and get a handle on my promised payments for the month, but i didn't follow through. So, i promised more than i could pay. Had i not changed my vehicle headlights and purchased some used speakers to battle my noisy neighbors, i may have been able to make it. The thing is, i would have had to skimp on my self-care in order to make all the payments and then be broke. I guess i subconsciously knew that, so i didn't run the numbers. Fact is, i needed groceries and things and that comes first, but it's too painful to realize that i can't have that AND deal with my creditors at the same time- something had to go. It all comes back to under-earning once again. I need steady work. So, I'm holding the line from going down the shame spiral here. I try to remember that a few years ago this would've brought me to my knees in panic, but today it's just business and i did what i could and let it go for the day. I had a fun New Year's eve with friends and wasn't stressed at all. I spent an hour on the phone with my bank (creditors closed till Wed) and got clarity on my options and what to expect. I will call BOA tomorrow to negotiate delaying my $410 for the month, it's too late to stop-pay on the transaction so it will bounce and incur penalty fees. The last I spoke to them, they said they could work with me if I was having trouble paying. My hope is that they were sincere and when I call them tomorrow and am up front about the situation, we can work it out. Welcome 2008...!

|

JAN 2008 - ONE FULL YEAR SINCE I DEFAULTED WITH MY CREDITORS AND STARTED DEALING WITH MY DEBT.

SAT 12/23/07

- Current statement from SALLIE MAE reveals that the estimated interest

I had been quoted for my period of forbearance in '07 was off. The

actual amount is less, as is my total principal. Goes to show how

difficult it is to establish real clarity in numbers. I remember the

guy on the phone estimating $700 in interest accrual, but it turned out

to be $222.87 on $9,414.29 principal. My new payments start a month

later than I thought as well. February '08 my monthly starts again at

$355.51 for 30 months. They estimate over the term an additional

accrual of $1,028.14 for a total debt of $10,665.30. I got a nice new

payment booklet in the mail too :-( (INCORRECT: see above)

|

THUR 12/20/07

- THE PAIN... I cannot make my minimum $2,952 pay to Wells Fargo Biz

Line, so I had to do all my numbers and project all my upcoming earnings

and then subtract all current and upcoming payments to see my bottom

line. (Of course, this would have already been done if I kept up with

my numbers) I had to go over it 2 or 3 times to make sense of it...

I first phoned Discover card. Since i paid off my

balance with them on 11-3-07, i have been waiting to see if/when my

"suspended" account will be "reinstated." When i made the payment they

said they couldn't possibly say when. Today they were very up front in

explaining it's a mandatory 6-month waiting period before a further

review and possible reinstatement. This is actually a new policy,

previously it was NEVER and your account was closed. They further

exlained that they will review my credit over the 6 months and if there is

anything going on, chances are i will be denied. After a denial, there

is aother 90 day wait and review. They will notify me by mail or i can

start calling them then. Ouch...

For the sake of clarity, my plan from

last month- to borrow $9,000 from Chase and make minimums and pay off

all of my Discover card so i could get it reinstated- was a mistake. The key issue was in asking Discover when i might get

reinstated on my account and when they said "they couldn't possibly say" (after

pressing them quite hard) i should've taken that as a bad sign.

However, i took the leap of faith, not really knowing what to expect,

and turns out i probably will never have my Discover account again (at

least not for 6 months.) So much for 20 solid years with no issue and 1 week of suspension. Now i have no way to follow through on my

settlement arrangements with Wells, BOA and BOA. This is really bad- but

falls under the category of "DO NOT continue the insainty of borrowing from Peter to pay Paul," and "no more un-secured debting no matter what." Lessons are always more painful the second time around.

I

next called my BOA personal acct to see if there was any wiggle room on my

$901 minimum settlement payment. There wasn't, so i asked if there was

any room for compromise on the remaining (3) payments after the initial

pay. The answer was yes. "Vanessa" was nice enough to drop my

settlement amount on the remaining payments! Instead of three equal monthly

payments of $700, she dropped it to (2) payments of $365. That's a

difference between $3,001 total to a $1,631 total. All this from an

original debt amount of $6,303 - a total debt forgiveness of $4,672! I

think she mis-read the notes on my account from the other agent, then

laughed and said "oh well, i just made it $365..." as if she couldn't (or wouldn't) undo her mistake. I did go over the original deal with her again for clarity and she laughed and said, "well it's in your favor" to which i replied, "oh yes, i'm not gonna argue with you."

Perhaps the fact that it's Christmas had something to do with it. So

the new settlement amount stands and I kept my scheduled pay of $901

scheduled.

I next phoned Christine at Wells to tell her I could not make my payment of $2,952. I explained "the angle i thought i could borrow from went away, now i have nothing i can give you."

She sounded unhappy but i asked if there was any wiggle room. She

finally offered that the best she could do is charge me the 10% minimum

they require (??) which would be $500. I would owe the balance of the

$2,952 less the $500 next month with my next payment- for a total of

$5,404. Then the total account would be settled and closed. I

scheduled the $500 even though i do not have it. I will have to

continue to work my numbers tonight and tomorrow. Luckily, the holiday

has everyone thrown off a day, so the posting date is't until next Wed

12-26-07. She said she would send an email to legal so that my account did get picked up by them. I don't know if she's playing me or not. She probably is.

WED 12-19-07 -

Horrible day. While working a crunch with a new client on my broken

computer, with no sleep and being sick the previous night- all my

creditors called. Unlike usual, i took the calls because i knew that

the coming holiday will throw off telephone tag time and i didn't wanna

miss something. I took the incoming calls, two threatened me with legal

if i didn't schedule the next minimum payments on my settlement

agreements. Not having kept up with my numbers since last month, i'm

totally vague about my money. What a stress. I went ahead and made

payment arrangments from my bank account and agreed to call each

tomorrow (Thur 12/20) before the Friday 12/21 deadlines. I'm having

resentment issues because i feel that after all the hoops i've jumped

through and all the disclosure and actual payments i've made- i would

like some respect instead of continued threats. On my way home i got a

fix-it ticket for a busted headlight. It was ok, the officer gave me

till February to fix. It actually helped calm me down.

|

|

|

| six months of receipts |

|

| |

SAT 12/8/07

- I reserved the community room near where I live to hold a "numbers'

gathering in preparation for year-end finances. I am behind more than

six months in my numbers! We met from 12ooon till 4pm and it took me

all of that time just to organize all my receipts since June. The great

thing about our gathering is I never would have caught up if I hadn't

done it in a group setting. Now I have to schedule time to input all

the figures into my Excel spreadsheet by the categories in the numbers

handbook. We decided we need to do this gathering semi-regularly,

perhaps once a month. We came up with the title "Safety in Numbers."

SAT 12/1/07

- TRIXIE'S BACK! I paid Bryan at LSI the $500 I borrowed 2 months ago.

I'm very grateful to Bryan for being flexible with the time frame. I

had initially expected to pay him back after 5 weeks, but it took 8

weeks. I GOT MY GUITAR BACK! I'm in heaven right now :-)

|

FRI 11/30/07 - I got up early after a fitful night of sleep (my action buddy called me AT 8:30AM to make sure I got up on time) and made my call to Christine at WELLS FARGO BIZ LINE at 9AM as agreed. I was prepared to offer her $5,000 of the $8,856 total in hopes of reaching a payment plan option on the remaining balance. As we began talking Christine said, "are you prepared to pay the 1st of the 3-pay installments we discussed?" Of course, we discussed no such arrangement. Typical of all my creditors, she didn't remember from one phone call to the next. I simply responded, "yes." So, I paid the first of three $2,925 payments over the phone (no fee) and she agreed we'd talk again in 30 days. So I kept the debt out of legal and bought some time. Since this amount was less than I had expected for today, I'm left with a larger amount of the CHASE $9,000 to work with.

I next phoned DISCOVER and paid off the entire $2,336 balance. I asked when my account might by re-instated, the woman said "we never know for sure- they will review it and let you know." I asked if this might happen before the holidays and she explained that she doesn't even try to guess anymore because they never know. There was also no other number for me to call and possibly find out. My strategy was to free up my Discover account so I could bounce more of the BOA and IRS debt before the new year. We'll see what happens. I feel a little better. She

also mentioned that they've been reporting me to the credit bureaus

each month I've been in default. I do not know if this is true. I now have $3,739 left from the CHASE advance.

I also sent my major design client a new deal memo giving myself a final raise for '07. It will kick in for Jan '08.

THUR 11/29/07 -

Tomorrow is the legal deadline with WELLS FARGO BIZ LINE and the $9,000 from CHASE posted to my bank account yesterday (TUE at 12mid) So I now have over $9 grand in the bank. This is surreal. I shared about it at my meetings because it's making my head spin. Some people suggested I go and get a computer to relaunch my business. I understand this urge, but I have to stay the course here. I do not want to create any new debt, just xfer some from one creditor to another to buy time and avoid legal. I did, however, break my 220+ days of abstinence from credit card usage :-(

I guess I will inquire with DISCOVER to see if I pay them first ($2,200) if they will re-instate my account and how long it will take to use the account again and what the limit will be. Perhaps then I can pay the other debts off and consolidate all debt with DISCOVER and buy some time again. This is what I have avoided doing for a year, although I was able to reach settlements with BOA so it was worth it. I'm very confused and I need a day to get some exercise and sleep and eat and H.A.L.T. and get back into my headspace properly. Spoke with Christine at Wells "pre-legal" and we made date/time to talk Fri morning to give her some money. I said "some money" and she said she would forward an email to legal saying we would be talking and tomorrow would have an answer for them as to "how we would be dealing with this." So, my hope is to offer them $5,000 toward the $8,856 total and have them keep the account and work out payment arrangement(s) for the remaining balance ($3,856)

WED 11/21/07 - I called CHASE bank credit dept. to inquire about a credit line I've had with them. I forgot I had it because it came automatically when SALLIE MAE bought my student loans from my original lender almost 10 years ago. I even tried to cancel the account before but was talked into keeping it for reasons I don't remember now. Christine at WELLS FARGO BIZ LINE reminded me of the account while looking at my credit report over the phone (argh.) So, reluctantly, I called Chase. Turns out I have a $9,500 credit limit with them. Ironic that I need $9,000. They offered me a 0% APR balance xfer offer (until July '08.) After hesitating and the guy telling me (if you call back the offer may be gone" I took the offer. He said it would take (5)days for the money to post to my bank account. Hopefully I can get it in time to pay Wells something before the 30th and the attorney takes my account there..

MON 11/26/07 - Received letter from DISCOVER- they have suspended my account. This is the first bad blood I've had with them since 1988. I had hoped to avoid this. DISCOVER is the one credit card I have intended to keep for emergencies and to continue building my good credit. I paid my vehicle insurance minimum due today by phone. My BOA minimum settlement payment is due this week and I already can't remember what day it gets electronically taken from my bank acct. ($410) I will have all the funds necessary to cover things (plus rent for 12/1) however, the Thanksgiving day wknd as thrown off the banking business days and I have no clarity on what will post when and where. I hope I do not overdraw my account. Not sure when the CHASE money will post either.

FRI 11/16/07 - Intending to call Wells Fargo, I got my notebook pages confused and accidentally called my BOA personal account. Thinking I was talking to Wells I went on about not being able to pay before charge-off and the woman offered me a settlement offer! I became suspicious I was talking to the wrong creditor so I asked her to verify the total. "$6,303" she replied. "there's a note on your account that we'll be willing to offer as low as $3,000 to settle but no more." I couldn't believe I called the wrong damn phone number and got a settlement offer. I agreed to call by her 11/21 deadline to decide. If I agree I'll have to pay a minimum of $901 by 11/30, then agree to (3) installments of $700 over three months. Hmm... not likely.

Next I called Wells correctly and spoke with "Christine.' Because we had phone tagged for weeks, she had not forwarded my account to legal after the Oct. 30th charge-off deadline, but had waited to speak with me first. I thanked her for that. I explained I still couldn't pay. She said the account would go to an attorney and they would begin to assess my worth for possible legal action. She then began to quote from my credit report which she had on her screen. Argh... what a freaky feeling! She explained how I had "excellent credit" still and could I perhaps use my Discover or Chase cards to pay? "Wow, you can see those?" I asked. (I hadn't even thought about my Chase card as an option. It came with another account I'd opened years ago and never used. I kept it because a banker explained it might help my credit history.) I explained that as a member of Debtors Anonymous I was practicing abstinence and don't use credit anymore. Also, my family and friends were not wealthy. I purposely said NOTHING about the fact that I have no property or soluble assets. She went on to explain that once it goes to an attorney, the present AND back-dated APR% fees that they were willing to waive (if I paid the principle $8,699) would come back into play and start accruing again. Also, the attorney would start tacking on their weekly retainer fee. The debt would likely become $20-$30,000 by the time a decision was met under a judge. (I'm also aware that court costs rack up heavily as well.) I told her I was out of options and she said she would extend my last deadline till November 30th- no more than that. So, now I have to decide where the hell I can borrow that money (debting- I have no collateral to offer) or just let it go to court. Sweet...

THUR 11/15/07 - My IRS monthly is due today. I also flaked and forgot to pay last month (argh.) I called the IRS to find out how to pay my previous months over-due amount as well as this months amount together. I wanted clarity because this months' statement only indicated my Nov bill, nothing more. This seemed odd. The man I spoke to was very nice, but - shock/surprise - had no info on his screen about my payment plan. He could quote only my total outstanding 2006 Form-1040 balance, but I had to explain I was on a payment plan of $35/month. At first he couldn't find anything. He finally found a previous payment dated from June. I insisted I was on a plan and for him to please look harder! He finally figured it out and explained that I owed for Oct and Nov. Wow- nothing like doing someone's job for them, especially the IRS. We then started discussing how to pay-by-phone (3rd party contracted service that cost fees) or pay online. The online pay option requires a "registration" process that involves getting assigned a PIN number. It takes 14 to 15 biz days and you get confirmation by snail mail. Argh!!! So I'm sending both payments by snail mail, MONDAY 11/19 - both late. Screw it.

TUE 11/6 thru WED 11/14 - sick with the flu, did nothing about anything.

|

SUN 9/20/07 - Couldn't make my rent, so I asked my dear friend Bryan at Light-Sound-Imagination for a cash loan of $500. In order to make the loan secured, I gave him the only thing of value I have - my girl Trixie. Trixie is my 1987 Fender Stratocaster electric guitar. Trixie was a gift from my mom for x-mas in '87 and she's been with me everywhere I've been since. Currently I play her roughly 1-1/2 hours a day, 6 days a week. My guitar is crucial to all of my writing, transposing and composing and is a big part of my daily life. In short, this sucks... We made the exchange and I told Bryan about D.A. for the first time. I came home, curled up in bed and sobbed. IT HAS TO GET WORSE BEFORE IT GETS BETTER. I know I'm doing this because I am working with my creditors and my D.A. program and not hiding in vagueness about the reality of my debt. For almost 2 months now, I've been climbing the walls without my guitar and it hurts everyday. A friend in program offered to loan me one of his guitars for a while but i told him, "this needs to sting" as part of my process of recovery. AAHHHHHHHHH !!!!

AUG 2007 - Requested my credit report from all (3) bureaus and built notebook for print-outs. Did not pay to get my FICO score, but all 3 reports show good standing. Only (1) has a blemish: it reads "BOA 180+ due - in negotiations." All other credit accounts read: "account good / pays on time." This is great, especially since I've been in default with BOA and Wells Fargo since Jan '07 and everyone else since Spring '07.

Also, I have started attending meetings of Al-Anon. Specifically, the "ACA" program of Al-Anon. This is after learning about the principles of the program from friends in D.A. I am also the poster child for this program. I am not working the program, but attending one meeting a week to remind myself of my issues and the wider spectrum of my personal emotional recovery. August '07 is my start month. Thanks and praise to God.

|

APRIL 2007 - I reached 4 months of abstinence from credit card usage and un-secured debting. However, I am flying my little sister out to L.A. for a visit we planned a year ago. In my life priorities, following through on my word and my promises to my little sis out-weigh my current commitment to not debt one day at a time. So, I am knowingly deciding to break abstinence and I bought her plane ticket with my DISCOVER card. I also paid for everything while she was here on the card and then my utility bills for May '07 with the card, before suspending usage. This was a difficult decision and I spoke at length with my action buddy and also brought it up at my latest PRG. My belief is that being of service to my little sis is spiritual and giving back where I receive spiritual food so this is a strange area. I debted and will have to work it out.

JAN 2007 - I stopped paying all of my creditors and chose to purposely go into "default." As scary as it is, I am working with the program of Debtors Anonymous and committing to my own "self care" by no longer jumping through impossible hoops to pay debts I simply cannot currently afford . I've been creating massive new un-secured debt by borrowing from one credit source to pay another. This is what we call INSANITY and I am choosing to STOP. I have built $8,000 in new debt on my WELLS FARGO BUSINESS LINE of credit since September (5 months.) I guess I got the message of D.A. on a delayed reaction: WE DO NOT HAVE TO EVER DEBT AGAIN.

I spoke with my loan institution SALLIE MAE and asked what options I may have during financial crisis and inability to pay. They offered a forbearance for 12 months. The accrual of finance charges over the 12 months will equal $700 total. This seemed plausible to me so I took the offer and it began immediately. I will return to monthly payments schedule in Jan '08 or have the option to file for another forbearance. This is a huge relief as it will stop $330/month that I cannot pay.

SEPT 2006 - While visiting home in NY I realized that my funds are running out and I will be late on payments so I called my banker at WELLS FARGO and he suggested I use my business credit line to transfer funds into my checking account. This credit line was something offered to me when I opened my business checking account in Oct '05. It was offered in order to get free checking or something I hardly remember- and as a way to build good business credit (bad business credit in my case.) Since I had (4) corporate gigs penciled in with my contractors for work that Fall, it seemed a matter of time, not money. I thought I would be getting the money from those jobs shortly, so I could pay off what I was borrowing. Here is an important lesson about debting because each of the (4) jobs were one by one cancelled. There ended up being no funds to pay off what I borrowed. First I borrowed $3,000 while on travel, then over the next few months, continued to transfer funds from the business line into my checking to cover bills, with no plan on how I would pay it off. Ouch...

|

MAY 2006 - I joined Debtor's Anonymous. At the advice of my therapist, I visited a meeting of "Artist's D.A." and for perhaps the first time in my life, felt like I was in a room full of people like myself. I relate to these people not just because of financial issues, but even more because they have the same life stories, interests, careers and emotions as me. I knew instantly I belonged here, but it took me a few months to commit to attending regular meetings. I am the poster child for this program. May, 2006 is my start month. Thanks and praise to God.

|

|